Table of Contents

- circle Choosing Between Fixed Amounts and Percentages in Estate Planning

- expand_circle_right How to Utilise Fixed Amounts and Percentages: Case Studies

- circle 3 Tips on Choosing the Right Method for Your Estate

- expand_circle_right How WillCraft Simplifies the Process

When writing your Will, one of the biggest decisions you’ll face is how to divide your assets among your beneficiaries.

“Should you leave fixed amounts or percentages?”

Both methods have their pros and cons, and the best choice depends on your unique situation and goals. This article will guide you through the differences, benefits, and drawbacks of each method, and how WillCraft can help you make the best decision for your estate.

Choosing Between Fixed Amounts and Percentages in Estate Planning

When planning your estate, it’s important to understand the different purposes served by fixed amounts and percentages.

Fixed Amounts

Fixed amounts are typically limited to specific gifts. This ensures a particular beneficiary receives a set amount of cash. Examples include:

- Insurance Policies: Allocating the exact payout amount.

- Education Funds: Ensuring a grandchild receives a specific amount for college tuition.

- Immediate Cash Needs: Providing a set amount to a spouse or child for immediate expenses.

Percentages

Conversely, when dealing with the entire estate, percentages are more appropriate due to the uncertainty of the estate’s overall value. Examples include:

- Real Estate: Allocating a percentage of property value to each beneficiary.

- Business Interests: Distributing shares of a family business.

- Investment Portfolios: Dividing the value of stocks, bonds, and other investments among heirs.

By combining both methods, you can provide flexibility and ensure your estate is distributed according to your intentions.

How to Utilise Fixed Amounts and Percentages: Case Studies

Now that we understand the difference between the two methods (fixed amounts vs. percentages) mentioned above, let’s apply them to real-life scenarios for a clearer picture.

Let’s consider the following two scenarios:

-

**Scenario 1:Your estate grows in value. **

-

Scenario 2: Your estate shrinks in value.

Scenario 1: A Growing Estate Value

Imagine at the time of executing your Will, your real estate is worth S$500,000. You decide to give S$250,000 to your wife and S$125,000 to each of your two children.

However, upon your demise, the value of your real estate has doubled to S$1,000,000.

-

Fixed Amounts: Your wife will receive S$250,000, and each child will receive S$125,000. The remaining S$500,000 will be unaccounted for and treated as a residuary asset.

-

Percentages: If you use percentages instead (e.g., 50% to your wife and 25% to each child), your wife will receive S$500,000, and each child will receive S$250,000. This accounts for the increased value, ensuring proportional distribution.

In this scenario, using the percentages method will make sure that all your assets are accounted for and none will be treated as a residuary asset.

Scenario 2: A Shrinking Estate Value

Imagine you have a piece of real estate worth S$1,000,000. You decide to give S$500,000 to your wife and S$250,000 to each of your two children.

However, upon your demise, the value of your real estate has decreased to S$800,000.

-

Fixed Amounts: If the property’s value decreases to S$800,000, there won’t be enough to distribute in accordance with your wishes. Your wife and children would need to agree to distribute S$800,000 that is proportionate in percentages. So your wife will get $400,000 and each child will receive S$200,000.

-

Percentages: By specifying percentages (e.g., 50% to your wife and 25% to each child), the distribution adjusts with the property’s value. If the property is worth S$800,000, your wife will receive S$400,000, and each child will receive S$200,000.

Combining Both Methods

Combining both fixed amounts and percentages can provide flexibility and ensure fair distribution regardless of the estate’s value. For instance, appointing a legal guardian for minor children and making financial arrangements such as setting up a trust for their care can be crucial.

Here’s how you can do it:

- Fixed Amounts for Specific Needs:

- Spouse: S$500,000 to ensure financial security.

- Each Child: S$125,000 to provide immediate support.

-

Percentages for Remaining Assets:

Remaining Estate: After allocating the fixed amounts, distribute the remaining estate based on percentages to account for any fluctuations in value, whether an increase or decrease of estate value at the time of execution of your Will.

-

Fixed Amounts and Percentages for a Specific Asset

You own a piece of real estate worth S$900,000, you can decide to give a fixed amount of S$500,000 from your property to your wife and the remaining be distributed to your children in equal percentages of 50%. That means your children will get $200,000 each.

If the property grows to S$1,000,000:

-

Your Wife: S$500,000

-

Each Child: S$ 250,000

If the property shrinks to S$800,000:

-

Your Wife: S$500,000

-

Each Child: S$150,000

To handle such situations, by combining both fixed amounts and percentages, you ensure that your wife receives a secure amount while fairly distributing the remaining estate among your children, regardless of fluctuations in estate value.

It does not matter whether you have a large or small estate; using a combination of fixed amounts and percentages can provide a balanced approach to distribution.

✔️Tip! We at WillCraft believe that percentages normally offer better flexibility and fairness in most situations.

3 Tips on Choosing the Right Method for Your Estate

Choosing between fixed amounts and percentages involves several considerations.

Tip 1: Assess the size and composition of your estate.

When deciding between fixed amounts and percentages for estate allocation, consider the type of asset, as it makes a significant difference:

- Real Estate: Use percentages to allow beneficiaries to share ownership without selling the property. For example, imagine a house. If you give based on a fixed amount, the property must be sold. However, if you allocate by shares, they can still hold the property based on percentage.

- Bank Accounts: Fixed amounts can ensure specific needs are met. Imagine a bank account where you want to ensure your wife is taken care of first. You decide to allocate S$50,000 to her to meet her needs. This can be done either as a fixed amount (“I leave S$50,000 to my wife”) or as a percentage, maintaining proportional distribution for the rest.

- Business Interests: Percentages work well for company shares, allowing shared ownership among beneficiaries.

- Insurance Policies: These typically have a fixed payout, suitable for specific dollar amount bequests.

Combining fixed amounts and percentages can offer flexibility and ensure your estate is distributed according to your wishes.

As mentioned above, we at WillCraft believe that percentage allocations generally offer better flexibility and fairness in most situations, regardless of the size of the estate.

Tip 2: Consider the number of beneficiaries and their individual needs.

Consider the number of beneficiaries and their individual needs. If you have multiple beneficiaries with varying financial situations, percentages can offer a fairer distribution.

For example,

If you have three children with different financial situations, you might allocate 25% to the financially stable one, 30% to the struggling artist, and 45% to the single mother.

However, if you have specific goals for each recipient or beneficiary, such as funding education or supporting a charity, fixed amounts might be more appropriate.

For instance,

You might leave S$100,000 for your grandchild’s college fund and S$50,000 to a favourite charity.

Tip 3: Think about your goals and intentions for each recipient.

Do you want to ensure that each beneficiary receives a specific amount, or are you more concerned with maintaining proportional fairness? Significant life events, such as marriage, divorce, or the birth of a child, can impact your decisions and should prompt a review of your Will.

For example,

If you want to ensure your spouse has a secure retirement, you might leave a fixed amount of S$500,000.

If you want to distribute your estate fairly among your children regardless of their current financial situations, you might allocate 50% to each of your two children.

Additionally, consider potential changes in your asset values over time. Estates can fluctuate due to market conditions, investments, and other factors, so flexibility might be crucial.

For example,

If you allocate 10% of your estate to each of your two children, their inheritance will adjust with the estate’s value. Alternatively, a fixed amount like S$100,000 for a grandchild’s education remains constant regardless of estate value changes. Combining methods, you could leave S$100,000 towards your grandchild’s education and distribute the remainder as percentages to your children to account for asset fluctuations.

How WillCraft Simplifies the Process

WillCraft’s user-friendly interface makes it easy to allocate your estate using either fixed amounts, percentages, or a combination of both. Our platform guides you through the process, helping you make informed decisions about your estate distribution.

Allocating Specific Assets with WillCraft

WillCraft allows you to allocate various types of assets, ensuring that all your possessions are covered. Here’s how you can manage different assets:

Bank Accounts:

- Specify the exact amount or percentage from each bank account.

- Example: “I leave S$50,000 from my DBS savings account to my daughter Sarah.”

Companies:

- Allocate shares or ownership percentages.

- Example: “I leave 30% of my shares in XYZ Company to my son John.”

Insurance Policies:

- Designate beneficiaries for the payout.

- Example: “I leave the proceeds of my life insurance policy to my spouse.”

Investment Accounts:

- Allocate specific investments or percentages of the account.

- Example: “I leave 50% of my investment account to my daughter Sarah.”

Real Estate:

- Specify properties, such as residential property, and their respective beneficiaries.

- Example: “I leave my house at 123 Clementi Ave to my son John.”

WillCraft provides the required fields to fill in for each asset type, ensuring that all your assets are covered comprehensively.

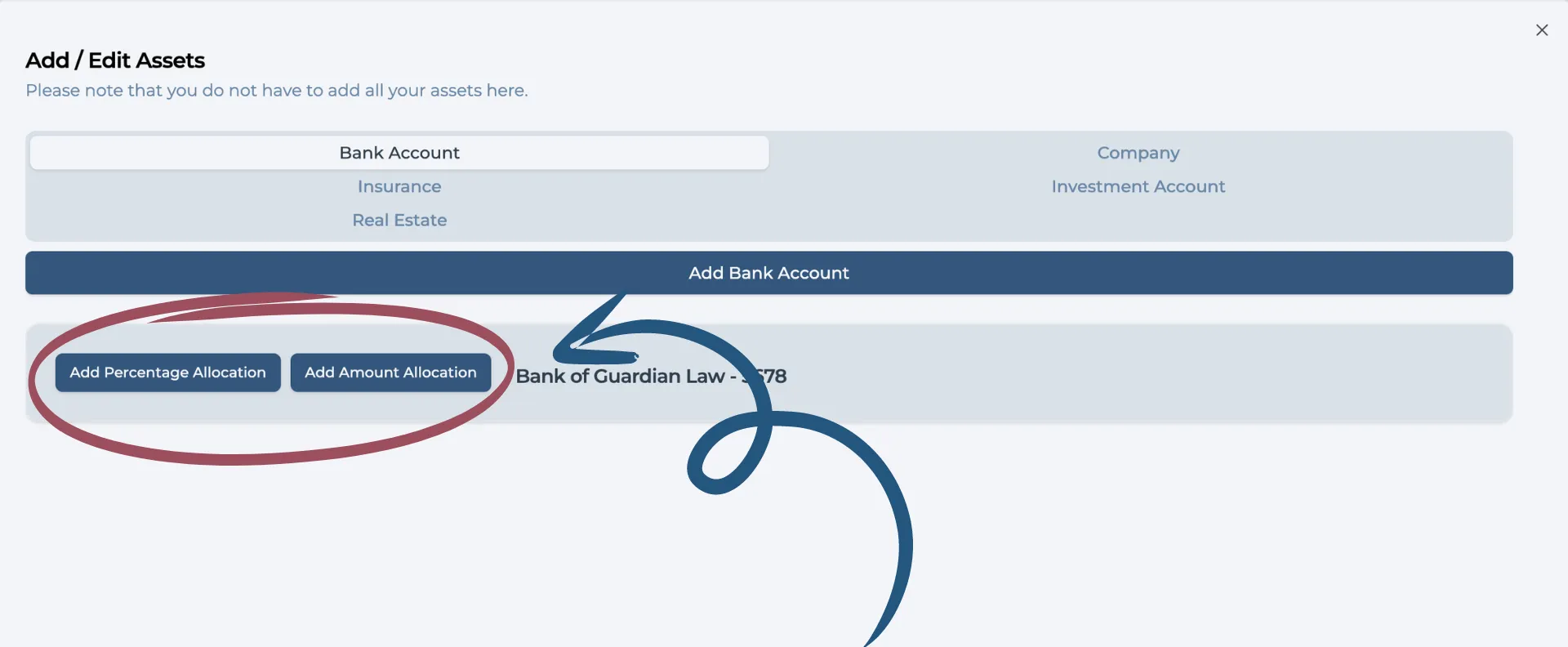

To give you a better idea of how straightforward this process is, let’s take a look at how you can allocate fixed amounts and percentages to your beneficiaries using WillCraft. The following screenshots illustrate the steps involved in making these allocations, ensuring that your estate is distributed exactly as you wish.

It’s important to note that certain assets like CPF funds cannot be included in a Will. CPF funds require nomination for disbursement. For more details on how CPF fits into your estate plan, including information on Wills and CPF, refer to our article here.

Conclusion

Remember, the best allocation method depends on your unique circumstances. Consider factors like the size of your estate, the number of beneficiaries, and your goals for each recipient. And don’t forget to review your Will regularly to ensure it still reflects your wishes as certain major life events and assets can change over time.

Create a Will that perfectly reflects your wishes with WillCraft!

Ready to start planning your estate allocation?

Note: Trying out WillCraft's interface is free! No credit card is required.