Table of Contents

In Singapore, the concept of simultaneous death - where parents or spouses pass away at the same time - can significantly impact asset distribution. Without a Will, the distribution of assets can become complex and may not align with the deceased’s wishes. This article explores the legal implications and the importance of having a valid Will to protect your family’s future.

The Hard Truth: When Parents Pass on at the Same Time

In Singapore, when two or more people die under circumstances where it’s unclear who passed away first, the law assumes that the younger person survived the elder. This legal presumption, known as the presumption of survivorship, affects how both the deceased’s estate is distributed, particularly when there is no Will. This can lead to emotional challenges, complications, and disputes among surviving family members who may have differing expectations about asset distribution.

For example,

If a husband and wife die simultaneously in an accident, and the wife is younger, she is presumed to have survived the husband. This means that her husband’s estate should be distributed first in accordance with his Will or intestacy rules. Thereafter, her estate (which includes her inheritance from her husband’s estate) will be distributed according to her Will or the Intestate Succession Act if she does not have a Will.

How Legal Tools Can Help

- Survivorship Clause

A survivorship clause is a rule in a Will that requires one person to outlive another by a certain period to inherit their assets. This is commonly used between spouses or parents to ensure that if they pass away around the same time, the assets are distributed according to their wishes.

For example,

If a husband and wife include a survivorship clause in their Wills, it could specify that the surviving spouse must live for at least 30 days after the other to inherit their assets. If they both pass away within that period, the assets would then go directly to the substitute beneficiaries.

- Mirror Wills

Mirror Wills are identical Wills made by two people, usually a couple, to ensure that their assets are handled the same way if either of them passes away. This helps make sure that their shared wishes are respected.

For example,

If both partners want their estate to be divided equally among their children, mirror Wills ensure this happens no matter who passes away first.

- Testamentary Guardianship

Testamentary guardianship allows you to name who will take care of your minor children if both you and your partner pass away. This is included in your Will so that your children are cared for by the people you trust most.

For example,

If you have young children, you can specify in your Will who you want to look after them to avoid a situation where the Court appoints a person you would not have wanted to look after your children..

By understanding and implementing these legal tools, you can ensure that your assets are distributed according to your wishes and that your loved ones are cared for, even in complex situations.

Scenarios of Estate Distribution in Simultaneous Deaths

Scenario 1: Accidents (No Will)

Imagine this scenario.

Imagine a couple, John and Mary, who are travelling together on a road trip. Unfortunately, they are involved in a severe car accident, and both pass away at the scene. Neither John nor Mary had a Will. According to the presumption of survivorship, the younger spouse (Mary) is deemed to have survived the older (John). As a result, John’s assets would first be transferred to Mary’s estate according to the Intestate Succession Act and then Mary’s estate will be distributed according to the Intestate Succession Act. However, this may not reflect John and Mary’s personal wishes.

Scenario 2: Natural Disasters (Both Have Wills)

Imagine this scenario.

Consider a family living in a coastal area of Singapore. During a sudden and severe flood, both parents, Alex and Sarah, tragically lose their lives. Both Alex and Sarah had valid Wills. In this case, since Sarah (the younger spouse) is presumed to have survived Alex, Alex’s assets would pass to Sarah’s estate first in accordance with his Will. Sarah’s Will would then dictate how the combined assets are distributed, ensuring that their estate is handled according to their wishes.

Scenario 3: Health-Related Incidents (One Parent Has a Will, the Other Doesn’t)

Imagine this scenario.

A couple, David and Lisa, both contract a severe illness and pass away within days of each other. David has a Will, but Lisa does not. As Lisa is the younger spouse, she is presumed to have survived David. This means David’s assets would first transfer to Lisa’s estate. However, since Lisa does not have a Will, her combined estate (including David’s assets) would then be distributed according to the Intestate Succession Act, potentially resulting in an outcome that neither David nor Lisa intended.

How WillCraft Can Help

Estate planning, especially for scenarios like simultaneous deaths, can seem complex and overwhelming. WillCraft, the first online platform for drafting Wills in Singapore, offers a streamlined process while ensuring your Will is legally valid.

- Cost-Effective: Save on legal fees with our online platform from just S$99.

- Expert Review: With WillCraft, you have the option of having your drafted Will reviewed and witnessed by our own lawyers (for just a small additional fee) to ensure that it meets Singaporean legal standards, offering peace of mind that your document is legally valid.

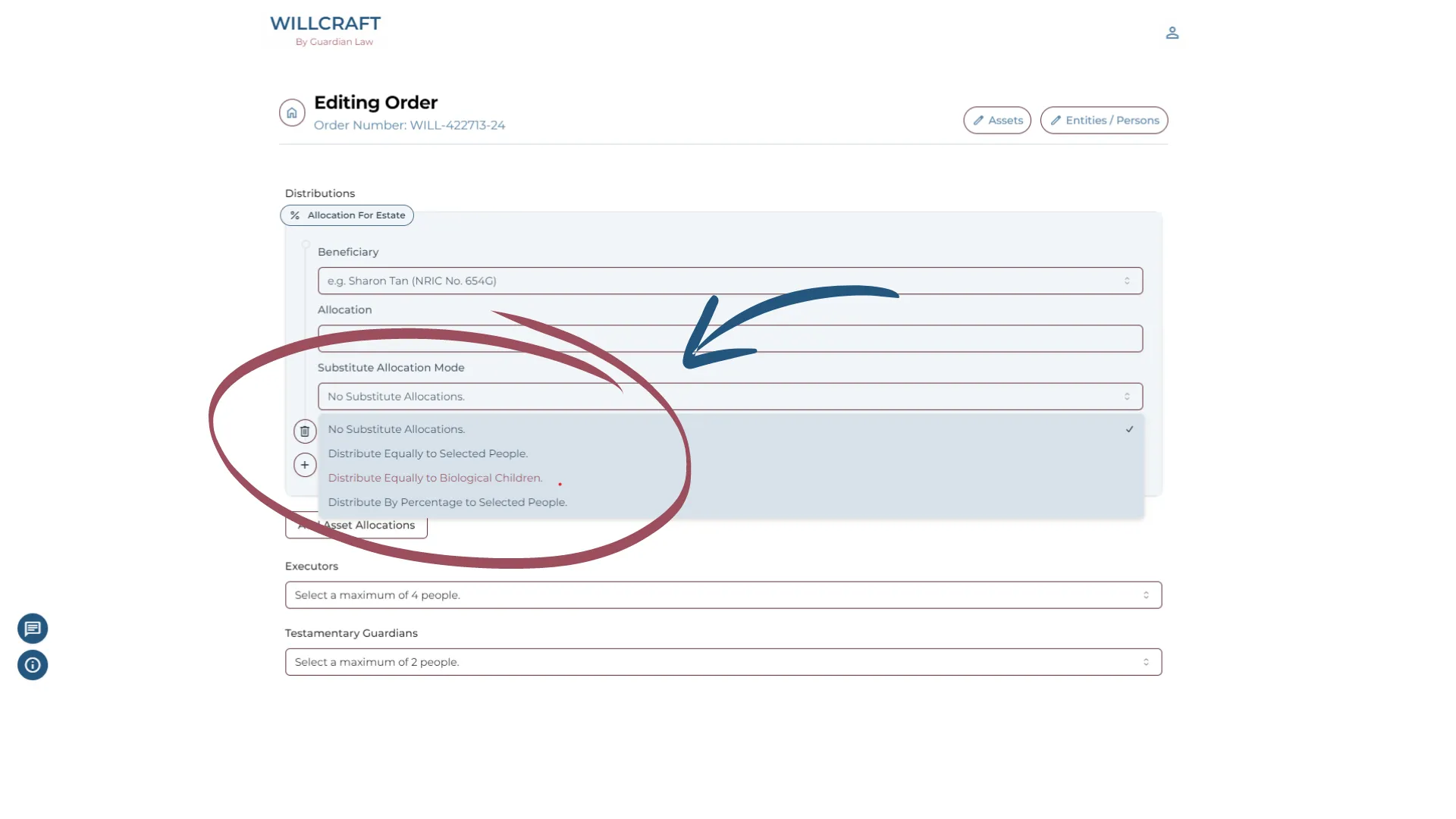

- User-Friendly Platform: Draft your Will from the comfort of your home in under 30 minutes, with clear guidelines at every step.

- Security: Your information is protected with advanced security measures.

- Comprehensive Support: We will guide you along the way with useful advice throughout the Will-drafting process to help you confidently make informed decisions.

With WillCraft, you can ensure your estate is managed according to your wishes, giving your loved ones security and clarity.

Conclusion

Understanding the implications of simultaneous deaths and having a comprehensive Will in place is essential for safeguarding your family’s future. By choosing WillCraft, you can ensure that your estate is managed according to your wishes, providing security and clarity for your loved ones.

Ready to protect your family's future in case of simultaneous deaths?

Create a Will that honours your wishes!

Note: Trying out WillCraft's interface is free! No credit card is required.

Frequently Asked Questions

What happens to assets if both parents die simultaneously or together without a Will?

If both parents die without a Will, their assets are distributed according to the Intestate Succession Act, which may not align with their personal wishes.

How does the law in Singapore handle asset distribution when both partners die at the same time?

In Singapore, the law requires both parents to be of sound mind and over 21 years old when drafting a Will. If both parents die at the same time, their assets are distributed according to the law, which may not align with their personal wishes.

Can having mirror Wills simplify estate distribution for couples?

Yes, mirror Wills ensure that both partners' estates are distributed in the same way, according to their shared wishes, even in the event of simultaneous deaths.

What is a survivorship clause, and how does it help in the event of simultaneous deaths?

A survivorship clause requires a beneficiary to outlive the testator by a certain period of time to inherit any part of the estate, ensuring assets are distributed to intended beneficiaries even if both parties die close in time together.

Why is testamentary guardianship important if both parents pass away together?

Testamentary guardianship allows parents to appoint guardians for their minor children in their Wills, ensuring children are cared for by trusted individuals if both parents pass away simultaneously.

What happens if one parent has a Will and the other doesn’t when both pass away at the same time?

If one parent has a Will and the other does not, the assets of the parent without a Will are distributed according to the Intestate Succession Act, which may complicate the estate distribution process.