Table of Contents

- circle Report the Death

- expand_circle_right Overview of Steps

Losing a family member is one of life’s most challenging experiences. The aftermath of such a loss can be overwhelming, filled with emotional turmoil and practical considerations.

In this article, we’ll explore the essential steps to navigate this challenging time. Understanding these steps is crucial for efficiently handling practical matters and ensuring your loved one is honoured respectfully. By being prepared and informed, you can focus on grieving and healing while taking care of necessary arrangements.

Whether you’re simply curious about what happens when someone dies, considering their wishes, or looking to handle their affairs, this article provides insights into what to expect.

Report the Death

When someone passes away, it’s crucial for you to promptly inform the appropriate authorities, depending on the circumstances surrounding the death.

It also depends on various factors such as the location and circumstances of the death.

Here are some examples:

- If the death occurs at home

-

Contact the deceased’s treating physician, especially if they were elderly or recently under medical care.

-

If the treating physician is unavailable, reach out to a local family doctor or any neighbourhood general practitioner (GP) for a house call.

-

If neither of the above options are feasible (For example, if the death occurs in the middle of the night),

You may dial 995 for an emergency ambulance, or dial 1777 for a non-emergency ambulance. You can find out more about emergency/non-emergency assistance services here.

Alternatively, you may consider seeking assistance from a funeral director for further guidance.

For deaths that occur at home, the next of kin must arrange for a doctor to verify the death (i.e. death from natural causes), after which the doctor will certify the death online, automatically registering it.

In cases where the cause of death remains uncertain or appears to be unnatural, additional investigation becomes necessary to ascertain the underlying reasons.

- If the death occurs in a medical facility (hospital, nursing home, hospice)

-

The doctor will examine and confirm the cause of death. If the cause is determined to be from natural causes and confirmed by the doctor, the death will be certified online, and the information will be submitted to the Immigration & Checkpoints Authority (ICA).

After the death is certified, it’s essential to promptly download the digital death certificate from the myLegacy website. **You must download the digital death certificate within 30 days. **

The death certificate is required for applying for a cremation or burial permit as elaborated further below.

Failure to download the death certificate within 30 days will necessitate applying for an extract of the death certificate. This process may take additional time and there will be fees payable.

What you’ll need to download a death certificate:

- Deceased’s NRIC, FIN, or passport number

- Death document number (this can be found on the temporary document issued by the hospital or doctor following the verified death)

- Date of death

After downloading the digital death certificate (which can be saved on the next of kin’s personal devices), you will need to apply for a permit for a burial/cremation.

You can visit the NEA website here to apply for a permit by logging in with your SingPass. There you can find comprehensive information, including necessary documents and steps for cremation or burial arrangements.

You can manage the above processes independently or enlist the support of a funeral director.

Alternatively, for enquiries relating to application for burial/cremation permit, you may contact 6225 5632 - NEA 24-hours dedicated hotline.

For further guidance on the necessary procedures in reporting a death, you can refer to the ICA website or, myLegacy website, where comprehensive information regarding these steps are provided.

As you navigate through the difficult task of tending to the physical needs of your departed loved one and coordinating the funeral arrangements, there are also other additional considerations to address during this period of loss and adjustment.

To provide clarity and support during this trying time, we’ve condensed some key steps and considerations below.

Overview of Steps

Step 1: Notify Relevant Parties

👪 Inform immediate family members and relevant parties about the passing.

Step 2: Plan Funeral Arrangements

🌹 Begin organising the deceased’s funeral or memorial service in accordance with their wishes and preferences.

Step 3: Legal and Administrative Procedures

📝 Obtain legal documents like the death certificate, manage estate matters, deal with inheritance issues, and consider hiring a probate lawyer to handle probate and other legal matters.

Step 4: Financial Matters

💲 Notify financial institutions and manage the deceased’s finances and debts.

Step 5: Practical Considerations

🆘 Make arrangements for dependents, secure belongings, and delegate tasks.

Step 6: Emotional Support

🗣️ Seek support from family, friends, or counselling services to cope with grief and loss.

Now, let’s delve into each step in detail.

Step 1: Notify Relevant Parties

You should contact immediate family members and close friends to inform them of the passing. Notify the deceased’s workplace, if applicable, and inform other relevant parties such as caregivers, neighbours, or religious/community groups.

If the deceased had a Will crafted through WillCraft, please reach out to us via Whatsapp or email us at your earliest convenience to inform us of their passing. We will assist you with the necessary steps and procedures related to their Will.

Step 2: Funeral Arrangement

Initiate the process of arranging the funeral or memorial service for your departed loved one, ensuring that every detail aligns with their wishes and preferences. This includes deciding on the type of service, location, date, and any special customs or rituals that hold significance to the deceased and their loved ones.

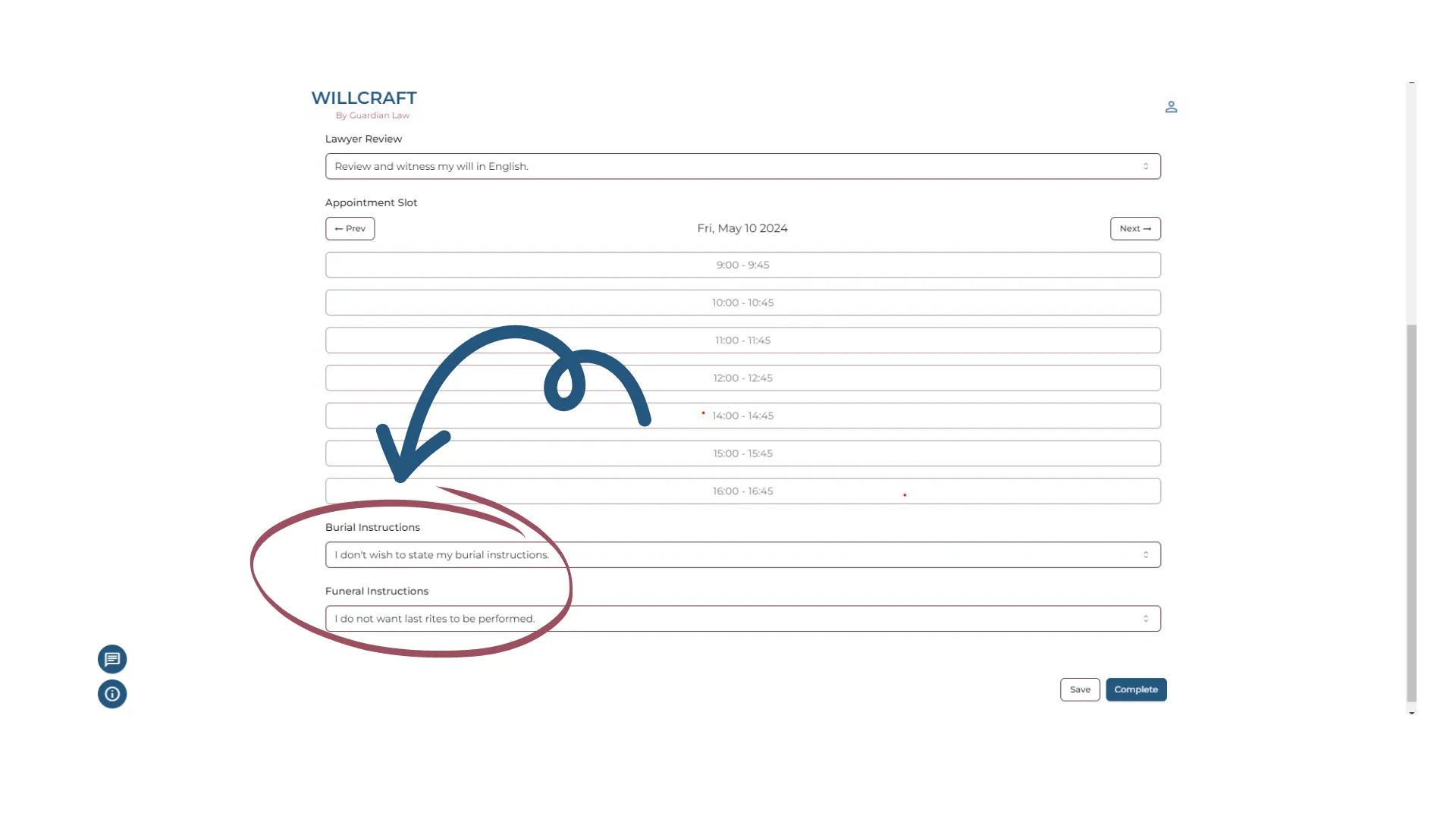

With WillCraft, loved ones who have crafted their Will with us have the opportunity to pre-plan their arrangements, including their preferred burial or funeral arrangements and the type of rites they prefer, reflecting their unique desires and ensuring their final wishes are honoured respectfully.

Step 3: Financial Matters

- Notify relevant financial institutions (banks, insurance companies, etc.) about the passing of your family member.

- This includes informing banks, credit card companies, mortgage lenders, and other financial entities they were associated with.

- Determine any outstanding debts or financial obligations of the deceased.

- This could include mortgages, loans, credit card balances, utility bills, etc.

- Consider seeking guidance from a financial advisor or a lawyer for estate matters if applicable.

- They can assist with tax implications, estate distribution, and asset management.

If the deceased had created a Will with WillCraft, the process becomes streamlined. Our Will template encompasses detailed allocation of assets and estate planning. In the event of the deceased’s passing, family members can refer to the Will created with WillCraft. This eliminates the need to make difficult decisions during an already challenging time, as the deceased’s wishes are clearly outlined.

Step 4: Other Practical Considerations

-

Care of Dependents

-

Securing Property and Belongings

-

Delegating Tasks

-

Care of Dependents

Make arrangements for the ongoing care of dependents. Examples of such dependents can be:

-

Spouse or Partner: A spouse or partner who relied on the deceased for financial support or caregiving.

-

Children: Minors who were financially dependent on the deceased.

-

Elderly Parents: Parents who relied on the deceased for care or financial support.

-

Disabled Family Members: Individuals with disabilities who depended on the deceased for care or financial assistance.

-

Pets: Animals that were cared for and dependent on the deceased for food, shelter, and care.

Coordinate childcare, temporary guardianship, or support services for elderly relatives.

Ensure pets are cared for by family, friends, or pet care services.

-

Securing Property and Belongings

If the deceased lived alone in an apartment, you should take steps to secure their property. This may involve locking all doors and windows, ensuring that valuable items such as jewellery or electronics are safely stored away, and keeping important documents like passports or Wills in a secure location.

Additionally, you might consider changing the locks or passwords to prevent unauthorised access and protect sensitive information or property from potential theft or misuse.

If the deceased lived in a rented apartment, ensure to follow the lease agreement’s guidelines for securing the property. Contact the landlord for advice and permission to change locks or passwords if needed.

If the deceased was the landlord of the apartment, additional considerations come into play. In such cases, it’s important to review the lease agreement’s guidelines and seek advice from legal experts on how to secure the property appropriately.

-

Delegating Tasks

During this stressful time, if you prefer to maintain privacy regarding the deceased’s assets, you can still delegate tasks effectively.

-

Consider entrusting funeral arrangements to a family member experienced in event planning without divulging financial details.

-

For managing accounts and debts discreetly, choose a relative skilled in finance.

This delegation not only lightens your workload but also provides emotional and mental support during this challenging period.

Coordinate care for dependents, secure the deceased’s property, and delegate tasks discreetly to trusted family members, ensuring efficient handling of practical matters during this challenging period.

Step 5: Managing the Deceased’s Estate: Considerations with or without a Will

Upon the passing of a family member, it’s essential to address legal and administrative matters promptly and efficiently. A deceased estate encompasses various assets such as:

- Real Estate: Properties such as houses, land, or commercial buildings owned by the deceased.

- Personal Property: Tangible assets like vehicles, jewellery, artwork, furniture, and other belongings (e.g. even golf memberships).

- Investments: Stocks, bonds, mutual funds, retirement accounts, and other investment portfolios.

- Business Interests: Ownership stakes in businesses or partnerships.

- Intellectual Property: Rights to patents, copyrights, trademarks, or royalties from creative works.

- Digital Assets: Online accounts, social media profiles, digital files, and cryptocurrencies.

- Insurance Policies: Life insurance policies, health insurance, or any other insurance coverage held by the deceased.

- Debts: Outstanding loans, mortgages, credit card balances, or any other liabilities owed by the deceased.

Obtaining a Grant of Probate or Letters of Administration after your loved one’s passing is crucial for executing the deceased’s wishes regarding their estate. These legal documents provide the authority to distribute the deceased’s assets according to their instructions.

The Grant of Probate is issued when there is a valid Will.

The Letters of Administration are granted when there is no Will or if the Will is deemed invalid.

-

Grant of Probate

The process of obtaining these grants involves verifying the authenticity of the Will and ensuring that it meets all legal requirements.

-

Letters of Administration

In cases where there is no Will, the process includes determining the legal heirs and adhering to intestacy laws.

Once granted, they empower the Executor or Administrator respectively to manage and distribute the deceased’s estate among beneficiaries as outlined in the Will or according to intestacy laws if there is no Will.

For more detailed information on Probate, Letters of Administration, and the distribution of assets, you can refer to our article - “The Process of Probate”.

Step 6: Emotional Support

Amidst the challenges, lean on loved ones, friends, or support groups for comfort and understanding. Seek professional help if needed, like counselling or therapy, to navigate the complexities of grief. Prioritise self-care activities that bring solace and rejuvenation, whether it’s mindfulness, hobbies, or nature walks. Remember, it’s okay to seek support—it’s a sign of strength, not weakness.

If you or someone you know is unable to cope with bereavement and depression, professional help is available.

Click here for a list of professional services and more information on coping with bereavement. Help and support are provided, so don’t hesitate to reach out. (Some services offer subsidies).

Planning Ahead with WillCraft

During such challenging times following the loss of a loved one, preparation becomes paramount. At WillCraft, we recognise the significance of planning ahead. By crafting your Will with us, you proactively address critical issues beforehand, ensuring that practical, financial, and emotional considerations are accounted for.

Our user-friendly platform empowers you to make informed decisions from the comfort of your own home, alleviating the burden of uncertainty. With a flat fee of S$99, you can secure the future for your loved ones, sparing them the stress during this already difficult period.

Don’t delay in safeguarding what matters most. Whether you’re facing the aftermath of loss or planning for the future, WillCraft is here to support you every step of the way!

Craft your Will with WillCraft today!

Overwhelmed by legal matters after a loss?

Note: Trying out WillCraft's interface is free! No credit card is required.